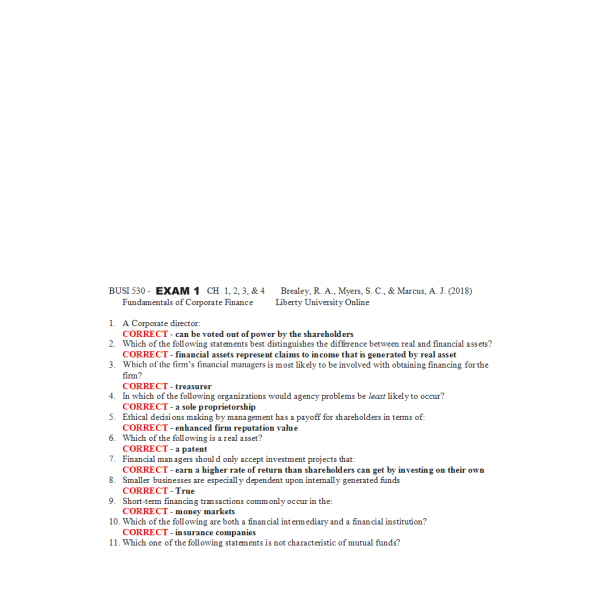

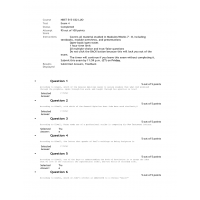

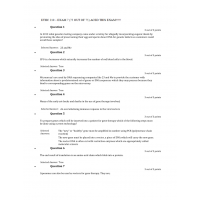

BUSI 530 Exam 1 - Question and Answers

BUSI 530 - EXAM 1 CH 1, 2, 3, & 4

Fundamentals of Corporate Finance Liberty University Online

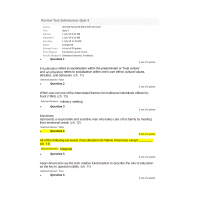

- A Corporate director:

- Which of the following statements best distinguishes the difference between real and financial assets? Which of the firm’s financial managers is most likely to be involved with obtaining financing for the firm?

- In which of the following organizations would agency problems be least likely to occur?

- Which of the following is a real asset?

- Financial managers should only accept investment projects that:

- Smaller businesses are especially dependent upon internally generated funds

- Short-term financing transactions commonly occur in the:

- Which of the following are both a financial intermediary and a financial institution?

- Which one of the following statements is not characteristic of mutual funds?

- The cost of capital:

- From June 2001 to June 2006, house prices in the United States rose sharply:

- Which of the following are major holders of corporate bonds?

- If the balance sheet of a firm indicates that total assets exceed current liabilities plus shareholder’s equity, then the firm has:

- Who pay taxes on earnings distributed s dividends?

- In general, what is changing as you read down the left-hand side of a balance sheet?

- A reduction in accounts receivable uses cash, reducing the firm’s net cast balance.

- What is the most likely conclusion for a firm whose statement of cash flows shows an increase in cash balances and has negative cash flows from both operations & financing?

- Which of the following cannot be used to reduce taxable corporate income?

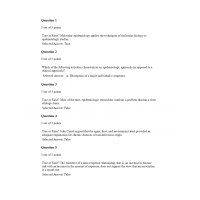

- An individual’s income for the year includes both dividend & interest payments. Which of these statements correctly applies to that individual tax liability?

- If market value of equity exceed book values of equity, then:

- Which of these indicates that a firm is efficient?

- Balscos balance sheet shows total assets of $238,000 & total liabilities of $107,000. The firm has 55,000 shares of stock outstanding that sell for $11 a share. What is the amount of market value added?

- Which of the following may be the best measure of company performance since it accounts for the opportunity cost of capital?

- The use of financial leverage will be detrimental to a firms ROE if the:

- Calculate the average collection period for Dots Inc. if its accounts receivables were $550 at the beginning of a year in which the firm generated $3,000 of sales?

- By how much must a firm reduce its assets in order to improve ROA from 10% to 12% if the firms operating profit margin is 5% on sales of $4 million? Assume that the reduction in assets has no effect on sales or profit margin

- What will be Gamma Inc.’s return on equity if total asset turnover is 0.85, operating profit margins are 0.15, two-thirds of its assets are financed through equity, & debt burden is 0.6?

- If a firms quick ratio is equal to its current ratio:

| Institution & Term/Date | |

| Term/Date | Liberty University |

-

$25.00