AHIP Test Review Unit 1 to 5

OVERVIEW of MEDICARE PROGRAM BASICS: CHOICE, ELIGIBILTY, AND BENEFITS

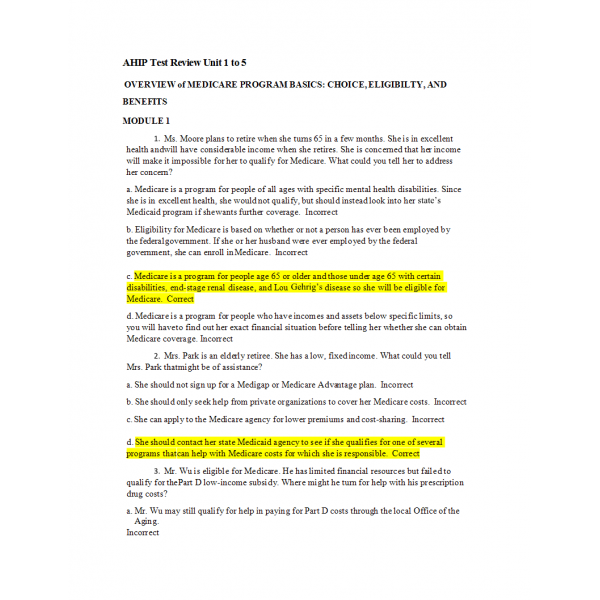

MODULE 1

1. Ms. Moore plans to retire when she turns 65 in a few months. She is in excellent health and will have considerable income when she retires. She is concerned that her income will make it impossible for her to qualify for Medicare. What could you tell her to address her concern?

2. Mrs. Park is an elderly retiree. She has a low, fixed income. What could you tell Mrs. Park that might be of assistance?

3. Mr. Wu is eligible for Medicare. He has limited financial resources but failed to qualify for the Part D low-income subsidy. Where might he turn for help with his prescription drug costs?

4. Mr. Schmidt would like to plan for retirement and has asked you what is covered under Original Fee-for-Service (FFS) Medicare? What could you tell him?

5. Mr. Buck has several family members who died from different cancers. He wants to know if Medicare covers cancer screening. What should you tell him?

6. Mr. Patel is in good health and is preparing a budget in anticipation of his retirement when he turns 66. He wants to understand the health care costs he might be exposed to under Medicare if he were to require hospitalization as a result of an illness. In general terms, what could you tell him about his costs for inpatient hospital services under Original Medicare?

7. Mr. Bauer is 49 years old, but eighteen months ago he was declared disabled by the Social Security Administration and has been receiving disability payments. He is wondering whether he can obtain coverage under Medicare. What should you tell him?

8. Mrs. Roberts has just received a new Medicare identity card in the mail. She is concerned that it is a forgery since it does not have her Social Security number on it. What should you tell her?

9. Mrs. Kelly, age 65, is entitled to Part A but has not yet enrolled in Part B. She is considering enrollment in a Medicare health plan (Part C). What should you advise her to do before she will be able to enroll in a Medicare health plan?

10. Mr. Moy's wife has a Medicare Advantage plan, but he wants to understand what coverage Medicare Supplemental Insurance provides since his health care needs are different from his wife's needs. What could you tell Mr. Moy?

MEDICARE HEALTH PLANS PART 2

1. Mr. Kumar is considering a Medicare Advantage HMO and has questions about his ability to access providers. What should you tell him?

2. Mrs. Radford asks whether there are any special eligibility requirements for Medicare Advantage. What should you tell her?

3. Mr. Wells is trying to understand the difference between Original Medicare and Medicare Advantage. What would be the correct description?

4. Mr. Sinclair has diabetes and heart trouble and is generally satisfied with the care he has received under Original Medicare, but he would like to know more about Medicare Advantage Special Needs Plans (SNPs). What could you tell him?

5. Mrs. Walters is enrolled in her state’s Medicaid program in addition to Medicare. What should she be aware of when considering enrollment in a Medicare Advantage plan?

6. Daniel is a middle-income Medicare beneficiary. He has chronic bronchitis, putting him at severe risk for pneumonia. Otherwise, he has no problems functioning. Which type of SNP is likely to be most appropriate for him?

7. Mrs. Lee is discussing with you the possibility of enrolling in a Private Fee-for-Service (PFFS) plan. As part of that discussion, what should you be sure to tell her?

8. Mrs. Davenport enrolled in the ABC Medicare Advantage (MA) plan several years ago. Her doctor recently confirmed a diagnosis of end-stage renal disease (ESRD). What options does Mrs. Davenport have in regard to her MA plan during the next open enrollment season?

9. Mr. McTaggart notes that a Private Fee-for-Service (PFFS) plan available in his area has an attractive premium. He wants to know what makes them different from an HMO or a PPO. What should you tell him?

10. Mr. Greco is in excellent health, lives in his own home, and has a sizeable income from his investments. He has a friend enrolled in a Medicare Advantage Special Needs Plan (SNP). His friend has mentioned that the SNP charges very low cost-sharing amounts and Mr. Greco would like to join that plan. What should you tell him?

MEDICARE PART D: PRESCRIPTION DRUG COVERAGE PART 3

1. Mrs. Sanchez lives in a state located near Canada. She has recently become eligible for Medicare and is considering enrollment in Part D prescription drug coverage. One of her friends has told her that she needs to be aware of something called TrOOP. What should you tell her when she asks you about TrOOP?

2. Mr. Jacob understands that there is a standard Medicare Part D prescription drug benefit, but when he looks at information on various plans available in his area, he sees a wide range in what they charge for deductibles, premiums, and cost sharing. How can you explain this to him?

3. Mrs. McIntire is enrolled in her state’s Medicaid plan and has just become eligible for Medicare as well. What can she expect will happen with respect to her drug coverage?

4. Ms. Edwards is enrolled in a Medicare Advantage plan that includes prescription drug plan (PDP) coverage. She is traveling and wishes to fill two of the prescriptions that she has lost. How would you advise her?

5. Mr. Rice has coverage for medical services and medications through his employer’s retiree plan. He is considering switching to a Medicare prescription drug plan because his retiree plan does not cover two important medications. What should he consider before making a change?

6. All plans must cover at least the standard Part D coverage or its actuarial equivalent. What costs would a beneficiary incur for prescription drugs in 2020 under the standard coverage?

7. Mr. Hutchinson has drug coverage through his former employer’s retiree plan. He is concerned about the Part D premium penalty if he does not enroll in a Medicare prescription drug plan, but does not want to purchase extra coverage that he will not need. What should you tell him?

8. Mrs. Allen has a rare condition for which two different brand name drugs are the only available treatment. She is concerned that since no generic prescription drug is available and these drugs are very high cost, she will not be able to find a Medicare Part D prescription drug plan that covers either one of them. What should you tell her?

9. Mr. and Mrs. Vaughn both take a specialized multivitamin prescription each day. Mr. Vaughn takes a prescription for helping to regrow his hair. They are anxious to have their Medicare prescription drug plan cover these drug needs. What should you tell them?

10. Mrs. Lopez is enrolled in a cost plan for her Medicare benefits. She has recently lost creditable coverage previously available through her husband’s employer. She is interested in enrolling in a Medicare Part D prescription drug plan (PDP). What should you tell her?

MARKETING MEDICARE ADVANTAGE AND PART D PLANS PART 4

1. Medicare health plans establish provisions in marketing representative contracts to ensure compliance with applicable laws and policies. If non-compliance occurs, CMS can penalize a plan in which of the following ways?

2. ABC is a Medicare Advantage (MA) plan sponsor. It would like to use its enrollees' protected health information (PHI) to market non-health related products such as life insurance and annuities. To do so it must obtain authorization from the enrollees. Which statement best describes the authorization process?

3. Mr. Lynn, an agent for Acme Insurance, Inc. thinks that, since state laws are preempted with regard to the marketing of Medicare health plans, he doesn't have much to worry about. What might you, as his colleague, advise him concerning the type of scrutiny he will be under?

4. You are mailing invitations to new Medicare beneficiaries for a marketing event. You want an idea of how many people to expect, so you would like to request RSVPs. What should you keep in mind

5. You work for a company that has marketed Medigap products for many years. The company has added Medicare Advantage and Part D plans and you will begin marketing those plans this fall. You are planning what materials to use to easily show the differences in benefits, premiums and cost sharing for each of the products. What do you need to do with your materials before using them for marketing purposes?

6. You are scheduled to give a sales presentation at a local senior center. At the beginning of the presentation, which of the following must you do?

7. Next week you will be participating in your first “educational event” for prospective enrollees. In order to be sure that you do not violate any of the applicable guidelines, in what activities should you plan to engage?

8. Agent Armstrong is employed by XYZ Agency, which is under contract with ABC Health Plan, a Medicare Advantage (MA) plan that offers plans in multiple states. XYZ Agency maintains a website marketing the MA plans with which it has contracts. Agent Armstrong follows up with individuals who request more information about ABC MA plans via the website and tries to persuade them to enroll in ABC plans. What statement best describes the marketing and compliance rules that apply to Agent Armstrong?

9. Another agent working for your agency claims that because you are not employed by the Medicare Advantage plans that you represent, you are not subject to the same requirements as the plans themselves. How should you respond to such a statement?

10. You market many different types of insurance and ordinarily you spend time each evening calling potential clients. To be in compliance with requirements for marketing Medicare Advantage and Part D plans, what must you do about contacting potential clients to market those plans?

ENROLLMENT GUIDANCE MEDICARE ADVANTAGE AND PART D PLANS PART 5

1. You are visiting with Mr. Tully and his daughter at her request. He has advanced Alzheimer’s and is incapable of understanding the implications of choosing a Medicare Advantage or prescription drug plan. Can his daughter fill out the enrollment form and sign it for him?

2. Mrs. Burton is in an MA-PD plan and was disappointed in the service she received from her primary care physician because she was told she would have to wait five weeks to get an appointment when she was feeling ill. She called you to ask what she could do so she wouldn’t continue to have to put up with such poor access to care. What could you tell her?

3. You have come to Mrs. Midler’s home for a sales presentation. At the beginning of the presentation, Mrs. Midler tells you that she has a copy of her medical record available because she thinks this will help you understand her needs. She suggests that you will know which questions to ask her about her health status in order to best assist her in selecting a plan. What should you do?

4. You are meeting with Ms. Berlin and she has completed an enrollment form for a MA-PD plan you represent. You notice that her handwriting is illegible and as a result, the spelling of her street looks incorrect. She asks you to fill in the corrected street name. What should you do?

5. Mrs. Johnson calls to tell you she has not received her new plan ID card yet, but she needs to see a doctor. What can she expect to receive from the plan after the plan has received her enrollment form?

6. Mr. Garcia was told he qualifies for a Special Enrollment Period (SEP), but he lost the paper that explains what he could do during the SEP. What can you tell him?

7. Mr. and Mrs. Nunez attended one of your sales presentations. They’ve asked you to come to their home to clear up a few questions. During the presentation, Mrs. Nunez feels tired and tells you that her husband can finish things up. She goes to bed. At the end of your discussion, Mr. Nunez says that he wants to enroll both himself and his wife. What should you do?

8. Mrs. Valentino is currently enrolled in a Medicare Cost plan. This plan is no longer meeting her needs, but it is now mid-year and past the annual election period (AEP). What would you say to Mrs. Valentino regarding her options?

9. Mrs. Disraeli is enrolled in Original Medicare (Parts A and B) and a standalone Part D prescription drug plan. She has recently developed diabetes and has suffered from heart disease for several years. She has also recently learned that her area is served by a SNP for individuals suffering from such a combination of chronic diseases (C-SNP). Mrs. Disraeli is concerned however, that she will have few rights or protections if she enrolls in a C-SNP. How would you respond?

10. If Mr. Johannsen gains the Part D low-income subsidy, how does that affect his ability to enroll or disenroll in a Part D plan?

| Institution & Term/Date | |

| Term/Date | AHIP Test |

AHIP Test Review Unit 1 to 5

- Product Code: 2022

- Availability: In Stock

-

$45.00

Related Products

COUN 6312S Week 7 Quiz

$14.99

PUBH-4030-3 Week 2

$9.99

NURS 6635 Final Exam 2021

$35.00

HLTH 3115 Final Exam

$25.00

NURS 6560 Final Exam 1

$40.00

NURS 6560 Midterm Exam

$30.00

HSCO 502 Exam 2

$25.00

BUSI 435 Week 1 Quiz

$9.99

BUSI 435 Week 4 Quiz

$9.99

BUSI 650 Quiz 1

$9.99

BUSI 650 Quiz 3

$9.99

BUSI 650 Quiz 4

$9.99

HLTH 1005 Week 2 Quiz

$9.99

HLTH 1005 Week 3 Quiz

$9.99

HLTH-8035E Module 4 Quiz

$9.99

AHIP Test 2 and 3

$29.99

PSYC-2005-11 Week 1 Quiz

$9.99

PSYC 2003 Week 2 Test

$9.99

PSYC 2003 Week 3 Test

$9.99

PSYC 2003 Week 4 Test

$9.99

PUBH-4000-1 Week 6 Quiz

$9.99

PSYC 3004 Week 2 Quiz

$9.99

PSYC 3004 Week 3 Quiz

$9.99

COUN 6312S Week 7 Quiz: 0

$12.00

PSYC 2001 Week 3 Quiz

$9.99

PSYC 2001 Week 4 Quiz

$9.99

PSYC 3002 Week 1 Test

$9.99

PSYC 3002 Week 2 Test

$9.99

PSYC 3002 Week 5 Test

$9.99

PSYC 3003 Week 2 Test

$9.99

PSYC-3004 Week 3 Quiz

$9.99

PSYC-3004 Week 4 Quiz

$9.99

PSYC-3004-11 Week 5 Test

$9.99

PSYC-4002 Week 2 Quiz

$9.99

PUBH 4200 Week 3 Quiz

$9.99

SHRM Practice Questions

$0.00